Playing Upland requires an understanding of your assets. Properties that you buy cost UPX or USD, have value and provide you with passive earnings. It is important to understand the numbers behind your properties. Without understanding these numbers and simple calculations you are likely to incorrectly value a property and not list it accordingly. This will either lead to your property not selling, or selling too quicky!

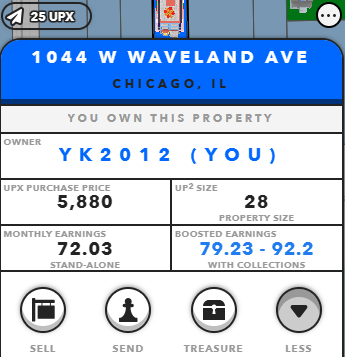

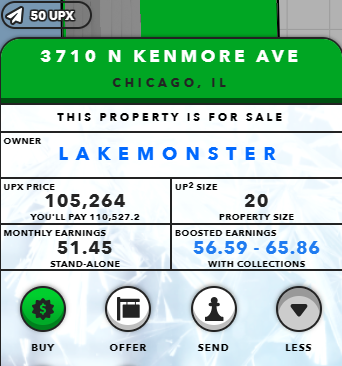

When you click on a property, you are able to see the property card with the information below. The property cards are 3 different colors based on the status of the property:

- Dark blue – property you own (left)

- Green – property not owned by you and for sale (middle)

- Light blue – property not owned by you and not for sale (right)

This page will review calculations of mint price, UP2 size, monthly earnings and boosted earnings.

Price Markup

Firstly, its impossible to calculate this value by looking at a picture of a property card that someone else posted. This means that if you look up those addresses listed above in game, you might see different values for the monthly earnings.

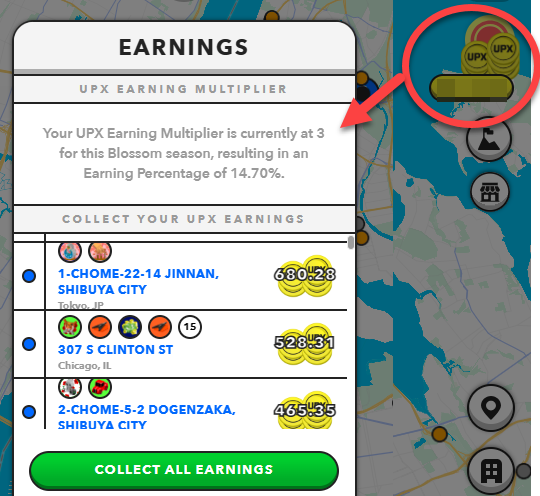

To calculate mint price and earnings, it is important to first understand your earning potential. The base property earnings are 4.9% annually based on property mint prices, and each season you have the ability to increase these earnings percentages up to 15.19%. Your current earning percentage can be found in the picture below.

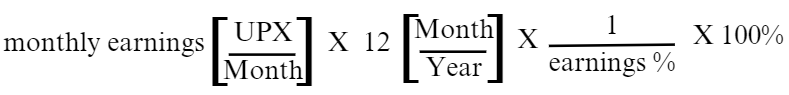

To calculate the original mint price of a property, use the following formula:

For example,

Using 1044 W. Waveland Ave (left picture above) as an example, we can verify that the

mint price (5,880) = monthly earnings (72.03) x 12 / 14.7 (my current earnings) x 100

Price Markup

When you are looking to purchase a property on the secondary market, you will want to know the markup percentage. This is calculated by dividing the sales price by the mint price.

Using 3710 North Kenmore (middle picture) as an example from the calculation above, we can find the mint price to be 4,200 UPX. By taking the sales price of 105,264 UPX , the markup is 105,264/4,200 x 100% = 2,506%. This means that the owner is looking to sell the property for 25 times what he paid for it.

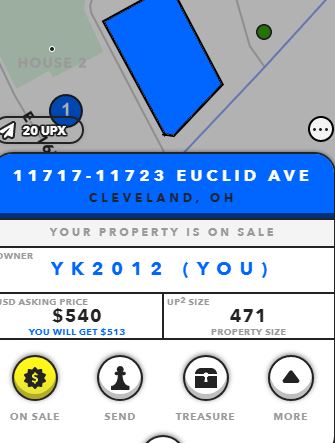

Note that when buying a property on the secondary market, a 5% sales fee is taken by Upland from both the seller and the buyer (when selling for USD or UPX). For the seller, this can be seen below under USD asking price, it calculates how much you will get. This 5% sales fee essentially means that you will only be receiving 95% of the asking price. Therefore the asking price ($540) x 0.95 = $513.

A 5% buyers fee is also taken by Upland from the buyer. Similar to how the property card for the seller says “you will get $XXX”, for the buyer it will says “you will pay $XXX”. A 5% buyer fee essentially means that the buyer will be paying 105% of the asking price. Therefore the buyer will pay $540 x 1.05 = $567

UP2 size

The UP2 size refers to the actual size of the property in the real world. 1 UP2 = 9 square meters. The UP2 number is important to know because it helps to determine the neighborhood value. Similar to the real world, if you own a plot of land in the suburbs and a same sized plot in downtown, obviously the one downtown will be worth more. This is also true in Upland. The size of the property is not always indicative of its value. Each neighborhood has its own value multiplier. Calculating the neighborhood value can be done using the mint price, or if it is unknown the monthly earnings.

neighborhood value = mint price / UP2

Neighborhood values can be compared between neighborhoods and between cities to better understand the status of the city or neighborhood. Each neighborhood value is predetermined by Upland and is not always reflective of real world statuses.

Monthly Earnings

By reorganizing the equation above we can calculate the monthly earnings from the mint price:

Monthly Earnings = Original mint price / 12 x earnings percentage / 100

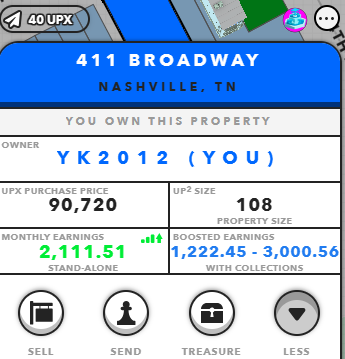

Note that if you are looking at the property tab of your own property, you might see the monthly earnings in green. This indicates that the property is currently active in a collection. If this is the case, calculate the base monthly earnings in the method listed below – boosted earnings, or click on the “title” button.

Upland has placed a cap on the maximum amount of UPX you can have uncollected at any given time. Learn more here to see how it affects you, and learn about all the ways you can earn in the metaverse.

Boosted Earnings

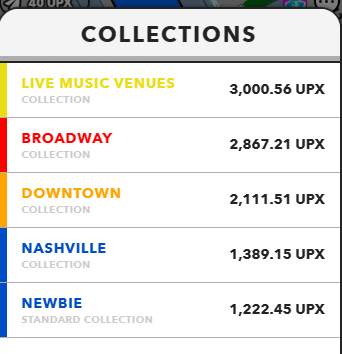

Each property can be placed into a collection, where you will earn a boost factor. For example, the Newbie collection gives you a 1.1x boost on your monthly earnings on the property that is active within that collection. By clicking on the numbers in the boosted earnings field (pictured below on the left) you are able to view the collections that the property is a part of (pictured below on the right), and the monthly earnings if the property is active within that collection.

From the collection earnings, you can always work back and determine the mint price from the newbie collection.

Mint price = Newbie standard collection monthly boost / 1.1 x 12 / earnings %

Where 1.1 is the boost for the newbie collection. If you know the boost factor of another collection that can be used instead of the 1.1x newbie boost.

For the example above, the mint price of the Broadway property is 1,222.45 / 1.1 x 12 / 0.147 = 90,690 UPX. If you are a new player and you are starting to fill your collections, read here for strategies when and how to fill them.

With this basic understanding of the property card, it is now more clear how each property is valued, and what to look for when you are looking up properties on the Upland Marketplace Analytics page.